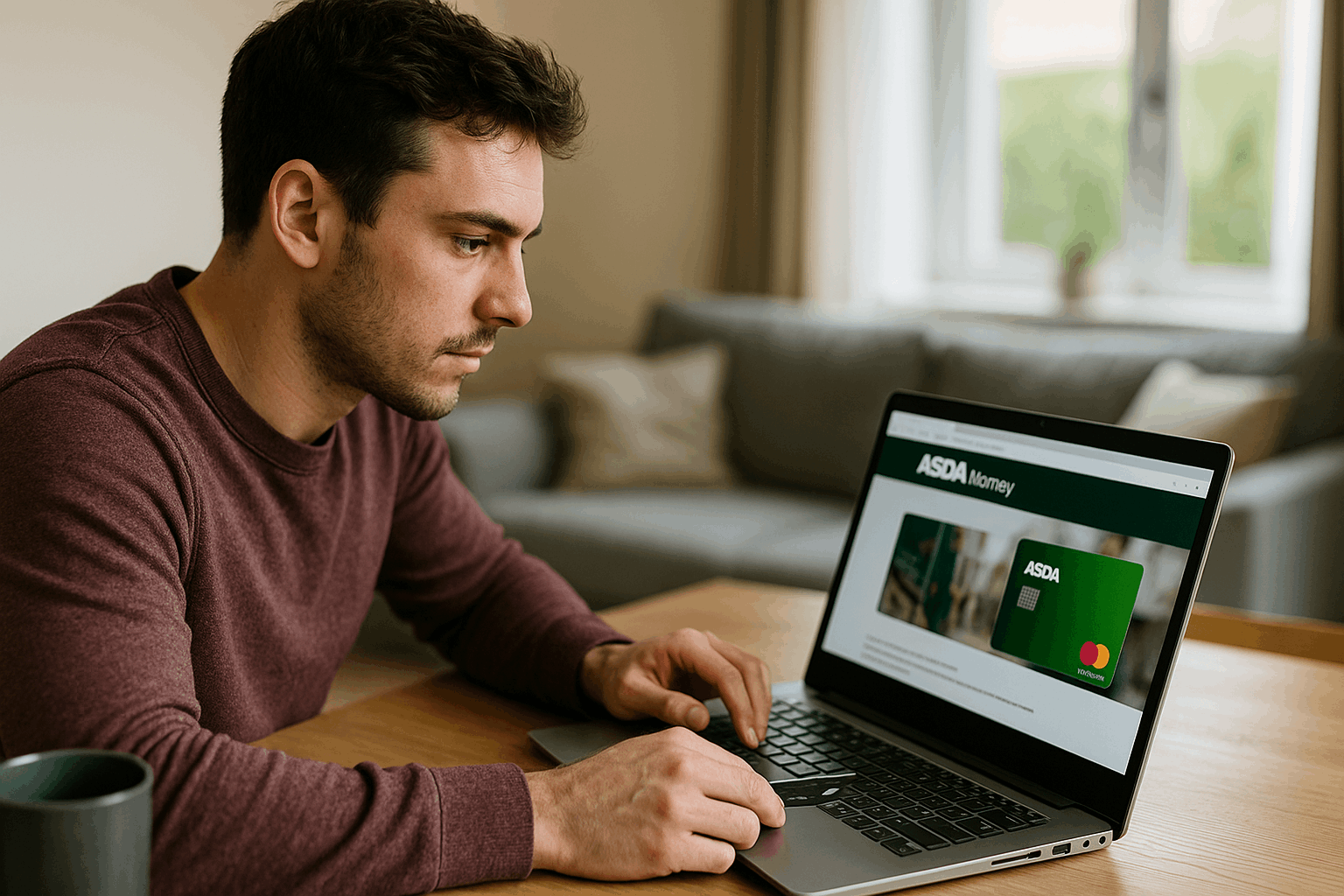

If you shop at Asda regularly, the Asda Money Cashback Credit Card is designed to turn your everyday spending into rewards.

The card pays cashback in the form of “Asda Pounds” that you collect in your Asda Rewards Cashpot and then redeem as vouchers in store or online.

Below is a clear guide on how the card works, how to apply, and what interest rates and contact details you should know before you apply.

How the Asda Money Cashback Credit Card Works

0.75% back in Asda Pounds on eligible spending at Asda (including Asda stores, Asda.com, George, Asda Petrol, Asda Opticians, Asda Mobile and Asda Tyres).

0.2% back on most other card purchases made elsewhere.

These rewards are credited to your Asda Rewards Cashpot and can be converted into vouchers to spend in store or online.

Vouchers are usually issued in set increments (for example, £1–£100) and have an expiry date, so you need to use them before they expire.

Step-by-Step: How to Apply Online

You apply for the Asda Money Cashback Credit Card online via the Asda Money website.

Pass a credit and affordability check carried out by the issuer using your application details and data from a credit reference agency (currently TransUnion).

Provide details of your income and regular financial commitments (such as rent, mortgage, and other credit).

Check your eligibility

Use any available eligibility checker to see your chances of approval.

This will normally carry out a “soft search” that does not affect your credit score but indicates how likely you are to be accepted.

Sign in or register with Asda.com

If you already have an Asda.com account (for groceries or George), sign in with your existing login details.

If you do not have an account, you will be asked to register as part of the application.

Complete the online application form

Enter personal details: full name, date of birth, contact information, and three years of address history.

Provide your employment status, income, and regular outgoings (such as rent, loans, and other credit cards).

Carefully read the pre-contract credit information and the card’s terms and conditions before you submit.

Underwriting and credit check

Once submitted, the lender runs a full credit check with the credit reference agency.

You may receive an instant decision, be approved with conditions, or be referred for further review.

In referred cases, you are typically contacted after a few working days with an update.

Account set-up and card delivery

If approved, you are given your credit limit and personalised interest rate within the card’s overall range.

The physical card is then posted to your registered address.

When it arrives, you can activate it, register it in the Asda Money Credit Card app, and add it to digital wallets such as Apple Pay or Google Pay if you wish.

Interest Rates and Fees You Need to Know

The Asda Money Cashback Credit Card has several key costs you should understand before applying.

- Representative APR: 29.9% APR (variable).

- APR range: often around 27.9% to 39.8% APR (variable), depending on your circumstances.

- Purchase interest: a monthly rate that broadly corresponds to the APR range above (for example, roughly 2.0%–2.8% per month).

- Balance transfers: usually charged at a similar interest rate range to purchases, unless a specific promotional rate is offered.

- Cash advances: tend to have higher interest, often equating to APRs of up to around 44.8%, plus a transaction fee.

On top of interest, you should be aware of other fees, which commonly include:

- No annual fee for holding the card.

- Cash withdrawal fee: 3% (minimum £3) on cash withdrawals and certain cash-like transactions.

- Non-sterling transaction fee: 2.99% on purchases made in foreign currencies.

- Paper statement fee: around £5 per paper statement if you choose this option.

- Late payment fee: generally £12 if you miss the minimum payment due date.

- The card typically offers up to 56 days of interest-free credit on purchases, but only if you pay your statement balance in full and on time each month.

How to Start Earning Asda Rewards with the Card

Once your card is activated and linked to your Asda Rewards account, earning is automatic when you spend.

Your rewards are collected in your Asda Rewards Cashpot, which you can manage through the Asda Rewards app.

From there, you can convert your Asda Pounds into digital vouchers and use these vouchers at the till in-store or when paying online at Asda.com

Asda may also run time-limited welcome offers or promotional bonuses, such as extra Asda Pounds for opening an account.

Contact Details and Address

If you have questions about the Asda Money Cashback Credit Card, you can contact customer services using the details below.

Asda Money Credit Card customer service (phone): 0808 175 4600

Typical opening hours: Monday to Friday, 9 am–5 pm (UK time), though you should check for any updates to these hours.

Issuer (lender) registered office: Jaja Finance Ltd, 27 Old Gloucester Street, Holborn, London WC1N 3AX

Conclusion

The Asda Money Cashback Credit Card can be a useful option if you are a frequent Asda shopper and want to turn your regular spending into Asda Pounds.

With 0.75% back on eligible Asda purchases, 0.2% back elsewhere, and no annual fee, it offers a simple way to earn rewards.

Before you apply, check your eligibility, read the latest Summary Box and terms, and make sure the card fits both your budget and your shopping habits.

Disclaimer: All product details, interest rates, fees, rewards percentages, eligibility criteria, and contact information in this article are based on information available as of November 2025 and may change at any time. This article is for information purposes only and does not constitute financial advice or a personal recommendation. Always refer to the official Asda Money and Jaja Finance documentation and your own credit agreement for the most up-to-date and legally binding terms, and consider seeking independent financial advice if you are unsure whether this card is suitable for you.