The Bank of America Customized Cash Rewards Credit Card gives you flexible ways to earn rewards on everyday spending.

You can select a 3% category that aligns with your habits to boost your cash-back potential.

This guide shows you how to apply for and use the card to earn more.

Key Features of the Customized Cash Rewards Card

Here are the key features you should focus on when checking the Bank of America Customized Cash Rewards Credit Card.

These points show how the card helps you earn more and manage your spending efficiently.

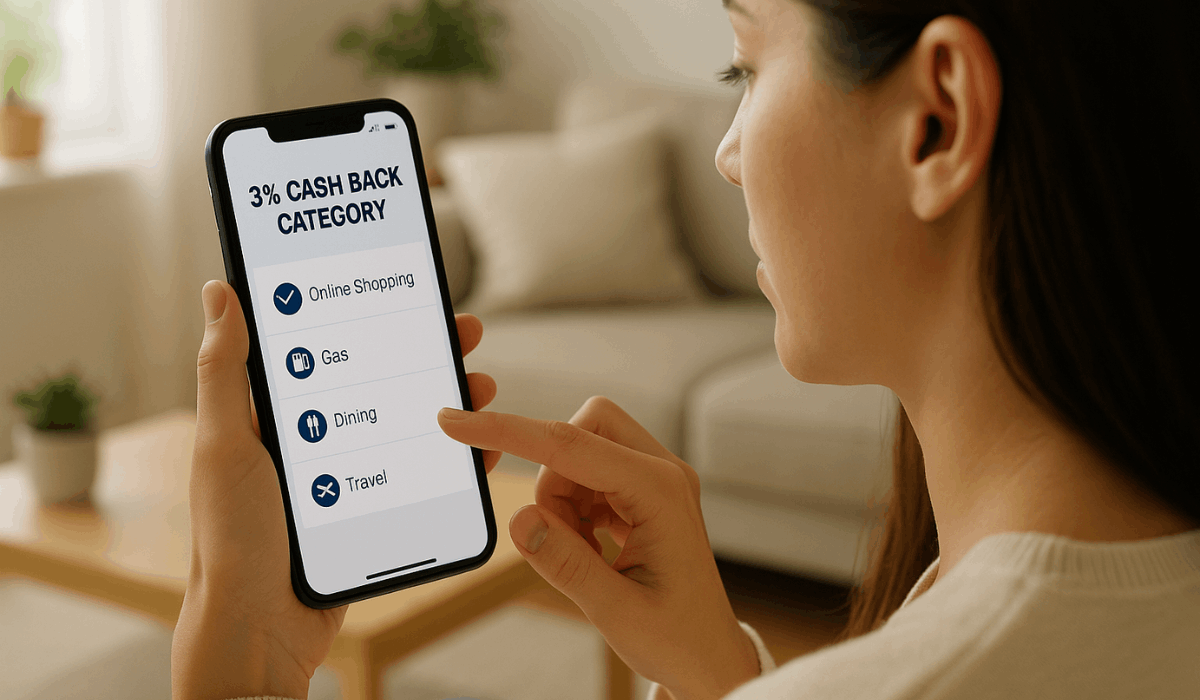

- 3% Category Choice – Lets you pick one top-earning category such as online shopping, gas, dining, or travel.

- 2% Rewards at Grocery Stores and Wholesale Clubs – Applies automatically to essential purchases.

- 1% Cash Back on All Other Purchases – Covers the rest of your spending.

- Quarterly Spending Cap – The 3% and 2% rates apply to the first $2,500 combined each quarter.

- $0 Annual Fee – Allows you to keep all the rewards you earn.

- Preferred Rewards Bonus – Increases your cash back by 25% to 75% if you qualify.

Cash-Back Breakdown

This breakdown shows how the card’s cash-back structure works and where each rate applies.

- 3% Category Choice – select one top-earning category such as online shopping, gas, travel, dining, drugstores, or home improvement.

- 2% Cash Back at Grocery Stores and Wholesale Clubs – applies automatically on essential purchases.

- 1% Cash Back on All Other Purchases – covers spending outside bonus categories.

- $2,500 Quarterly Cap – the 3% and 2% categories share a combined earnings limit each quarter.

- Unlimited 1% Earn Rate – all purchases beyond the cap continue earning at the base rate.

APR, Fees, and Important Rates

These rates help you understand the costs and benefits of using the Customized Cash Rewards Credit Card.

Reviewing them first ensures you know exactly how the card charges interest and fees.

- Purchase APR: 17.74% – 27.74% variable.

- Introductory Purchase APR: 0% for 15 billing cycles on purchases.

- Introductory Balance Transfer APR: 0% for 15 billing cycles on transfers made within the first 60 days.

- Balance Transfer Fee: 3% of the amount transferred if done within the first 60 days, then 4% thereafter.

- Cash Advance APR: 28.24% – 29.24% variable (median ~28.74%).

- Cash Advance Fee: 5% of each cash advance.

- Foreign Transaction Fee: 3% of each purchase made abroad.

- Annual Fee: $0 (no annual fee).

Requirements Before Applying

These requirements prepare you for the Customized Cash Rewards Credit Card and help improve your approval chances.

- Good to Excellent Credit Score – Most applicants qualify with a score in the high 600s or higher.

- Stable Income – Shows that you can manage monthly payments and credit limits.

- Valid Identification – Includes a government-issued ID such as a driver’s license or passport.

- U.S. Social Security Number or ITIN – Required for identity verification.

- Proof of Address – May include a utility bill, bank statement, or lease agreement.

- Clean Credit History – Fewer recent inquiries and no major delinquencies improve approval odds.

How to Apply Online

These steps guide you through the online application for the Bank of America Customized Cash Rewards Credit Card.

Follow each step to submit your request quickly and avoid delays.

- Go to the Bank of America Website – Visit the official site, open the credit cards section, and select the Customized Cash Rewards option.

- Click “Apply Now” – Start the digital form using the secure application page.

- Enter Your Personal Information – Include your name, address, Social Security number, and contact details.

- Provide Employment and Income Details – Confirm your job status and monthly or yearly income.

- Review the Terms and Conditions – Read the APR, fees, and reward rules before submitting.

- Submit Your Application – Wait for instant approval or a follow-up message if more review is needed.

How to Apply Through the Mobile App

These steps show how to apply for the Bank of America Customized Cash Rewards Credit Card using the mobile app.

Follow them to complete your application directly on your phone.

- Download the Mobile App – Install the official Bank of America app from your device’s app store.

- Sign In or Create an Account – Log in with your online banking details or register a new profile.

- Go to the Credit Cards Section – Open the menu and look for the products tab to access available cards.

- Select the Customized Cash Rewards Card – Tap the card to view details and start the application.

- Fill In Your Personal and Income Information – Enter your identity, employment, and financial details.

- Submit the Application – Send your request and wait for an instant decision or follow-up message.

Applying In-Branch

These steps show how to apply for the Customized Cash Rewards Credit Card in person.

This option is helpful if you prefer help from a banker during the process.

- Visit a Nearby Branch – Choose the closest location and go during business hours.

- Bring Valid Identification – Prepare your government-issued ID, Social Security number, and proof of address.

- Request to Apply for the Card – Tell the banker you want the Customized Cash Rewards Credit Card.

- Provide Your Personal and Income Information – The banker will enter your details into their system.

- Review the Terms Before Signing – Check the card’s APR, fees, and rewards structure.

- Submit Your Application – The banker will finalize your request and inform you of the approval result.

Ways to Maximize Your Cash Back

These tips help you increase the rewards you earn with the Bank of America Customized Cash Rewards Credit Card.

Use them to get the highest value from your spending.

- Choose the Right 3% Category – Pick the option that matches your most significant monthly expenses.

- Track the Quarterly Spending Cap – Stay aware of the $2,500 limit for 3% and 2% rewards.

- Use the Card for Eligible Everyday Purchases – Route groceries, gas, and select online spending through the card.

- Enable Preferred Rewards if Eligible – Boost your cash back by 25% to 75% through the program.

- Set Up App Alerts – Monitor spending and category changes through mobile notifications.

Managing Your Account After Approval

These steps help you manage your Customized Cash Rewards Credit Card smoothly after approval.

They keep your account organized and your rewards easy to track.

- Set Up Online Banking – activate your digital account to view transactions, statements, and rewards in one place.

- Download the Mobile App – use the app to monitor spending, redeem cash back, and change your 3% category.

- Enable Account Alerts – turn on notifications for payments, balances, and unusual activity.

- Schedule Automatic Payments – set up autopay to avoid missed due dates and late fees.

- Review Monthly Statements – check charges, interest, and reward totals for accuracy.

- Update Personal Information – keep your address, contact details, and income information up to date.

Contact Information

Here’s the contact information you can use for any questions or issues related to your credit card. These details help you reach the right support team quickly.

- Customer Service (U.S., 24/7): 800-732-9194.

- International (U.S. collect): 302-738-5719.

- Card Activation (U.S., 24/7): 800-276-9939.

- Mailing Address for Payments: P.O. Box 15019, Wilmington, DE 19886-5019.

- Mailing Address for Billing Inquiries: P.O. Box 672050, Dallas, TX 75267-2050.

To Wrap Up

The Customized Cash Rewards Credit Card gives you flexible earning options and simple ways to manage your account.

You can use its bonus categories and clear reward structure to increase your cash-back value.

Apply today to start earning more from your everyday spending.

Disclaimer

All information provided is for general guidance and may not reflect the most recent updates from the issuer.

Always check the official terms and conditions before submitting your application.