Applying for a credit card from Barclays Bank PLC through its Barclaycard brand is a simple process when done directly on the official website.

This guide explains the full application procedure, current interest rates, contact information, and key considerations before submitting your request.

Barclays Credit Cards

Here’s a comparison of several credit-card products from Barclaycard in the UK market.

| Card Name | Best For | Representative APR* | Key Features / Offer | Annual Fee |

|---|---|---|---|---|

| Platinum Balance Transfer | Moving existing high-interest balances to a card with low/0% interest for a set period | From 24.9% APR (variable) for many offers. | 0% on balance transfers for up to 35 months (with a fee). | £0 |

| Rewards Card | Everyday spending with cashback / rewards | ~ 28.9% APR (variable) | Earn rewards / cashback on eligible purchases. | £0 |

| Avios Card | Travellers who want to earn air-miles (Avios) | ~ 29.9% APR (variable) | Earn Avios points for purchases (e.g., 1 Avios per £1) and welcome bonus. | £0 |

| Avios Plus Card | Frequent travellers wanting lounge access + premium rewards | “Representative APR” shown as very high (e.g., 80.1% on some example deals) | Higher monthly/annual fee, richer perks (lounge access, bonus Avios) but higher cost. | ~£20/month (≈£240/year) |

| Forward / Credit-Builder Card | Those building or rebuilding credit history | ~ 33.9% APR (variable) (example) | Lower entry barrier; offers rate reduction if you pay on time for first year(s). | £0 |

Step-by-Step: How to Order a Barclays Credit Card

Before you begin, it’s essential to confirm your eligibility and understand the main credit terms.

Start by using the online eligibility checker on the Barclays website. This performs a soft credit search, meaning it won’t affect your credit score.

Ensure you meet the general requirements: you must be at least 18 years old and have a valid UK residential address.

Finally, prepare your personal and financial information, such as your UK address, contact number, employment details, income, and National Insurance Number.

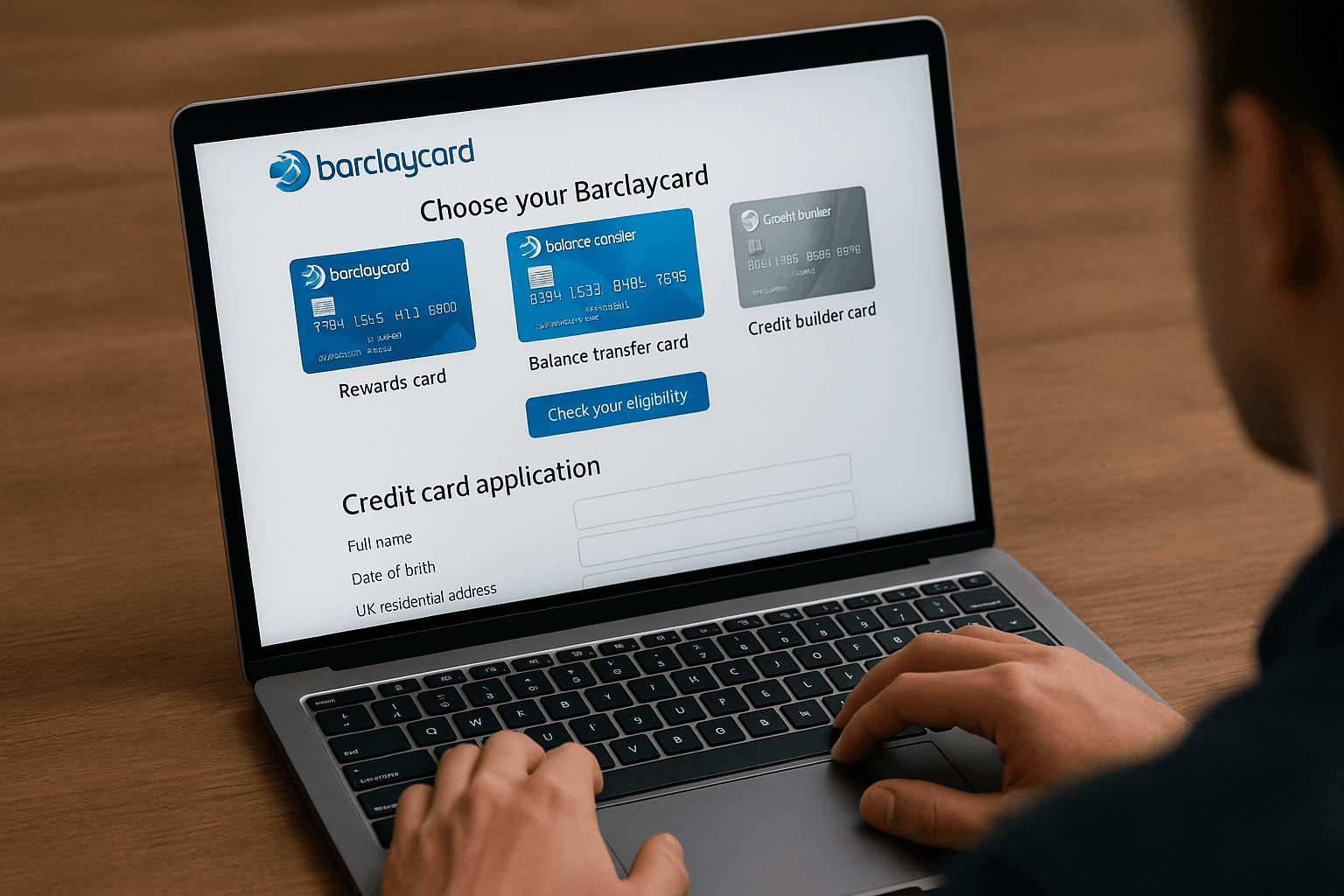

Step 1: Choose the Card on the Website

Visit the Barclays or Barclaycard website and go to the credit cards section.

Browse the available options.

For example, reward cards, balance transfer cards, or credit-building cards.

Compare their features carefully, focusing on interest rates, annual fees, and perks.

Step 2: Check Your Eligibility

Before starting the official application, click on “Check your eligibility.”

Provide basic details like age, income, and address.

Barclays will then run a soft credit check to tell you whether you are likely to be approved.

If you qualify, proceed to the full application; otherwise, you may need to build your credit history first.

Step 3: Fill in the Application Form

Click “Apply now” to open the secure application form.

You’ll need to provide:

- Full name, date of birth, and UK address.

- Employment status and annual income.

- Monthly financial commitments such as rent, loans, or other credit cards.

Details of any existing Barclays accounts, if applicable. Double-check your information before submitting to avoid delays or rejections.

Step 4: Review the Terms and Interest Rates

This includes the purchase rate, balance transfer rate, representative APR, and any introductory offers.

Some Barclaycard products offer 0% interest on balance transfers for up to 19 months (with a 3.45% fee) or 0% on purchases for a limited period.

Others, like the Barclaycard Rewards card, have a 28.9% APR variable.

Make sure you understand all rates and fees before accepting.

Step 5: Submit Your Application

After reviewing, click “Submit.” Barclays will run identity and credit checks to verify your information.

You may receive an instant decision online, though sometimes the bank may contact you for more documents or additional verification.

If approved, you’ll get confirmation via email or post, and your card will arrive at your registered address.

Step 6: Activate Your Card and Set Up Online Access

When your card arrives, activate it by following the enclosed instructions.

You can do this online or over the phone.

Once activated, create an online banking account or sign in to the Barclaycard mobile app.

From there, you can manage payments, set up direct debits, and check your statements easily.

Interest Rates and Example Numbers

Remember that APR includes both interest and fees. The exact rate you receive may differ based on your financial circumstances and credit history.

Purchase rate: 28.9% APR variable (Rewards card).

Balance transfer offer: 0% interest for 19 months, with a 3.45% transfer fee (Platinum card).

Credit-building card: initial rate may be reduced by up to 3% if all payments are made on time during the first year (Forward card).

Barclays Credit Card: Pros and Cons

Pros

- Wide range of card types: Barclaycard offers reward cards, balance-transfer cards, credit-building cards and purchase cards.

- Ability to check eligibility online before full application which uses a “soft” credit check so your credit score is not initially impacted.

- Good functionality in online banking and mobile apps for tracking spending, payments and alerts.

- Some cards include specific perks: for example the “Forward” credit-builder option gives a rate reduction for on-time payments, cashback in early months and no annual fee.

- Well-known and established issuer (Barclaycard / Barclays Bank PLC) with broad acceptance and infrastructure.

Cons

- Representative APRs are relatively high compared to some other cards when you carry a balance.

- Some reward or cashback rates are modest compared to premium cards or specialist providers; you may earn less than you might expect.

- Foreign transaction fees or non-sterling spending costs can be higher than debit cards or specialist travel cards; using abroad may incur extra cost.

- Customer service has received mixed reviews: some users report long wait times, difficulty reaching support or unclear communications.

- Credit limits and terms can be reduced or changed — for example one report mentioned a substantial credit-limit cut without warning.

- Changes in repayment terms (such as minimum payments) may increase the repayment period and total interest cost if only minimum repayments are made.

Contact Information: Bank Phone and Address

Registered Office: 1 Churchill Place, London E14 5HP, United Kingdom.

General Enquiries (Personal and Premier Customers): 03457 345 345 (within the UK) or +44 24 76 842 099 (from abroad).

Barclaycard Applications and Enquiries: 0333 200 9090.

Postal Correspondence for Barclaycard Payments: PO Box 292, Sheffield S98 1SD, United Kingdom.

Conclusion

Ordering a Barclays credit card online is a clear process when you follow the official steps.

Start by checking your eligibility, then carefully complete the application form, review the interest rates, and submit your request.

By applying through the official website and managing your account online, you can ensure a safe and convenient experience.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. All rates, terms, and contact details are subject to change. Applicants should always confirm the most up-to-date information directly with Barclays or Barclaycard before applying.